SEP Engine Trading Platform - Integration Phase

Current Status: Workbench Integration & Pattern Analysis

Phase Objectives

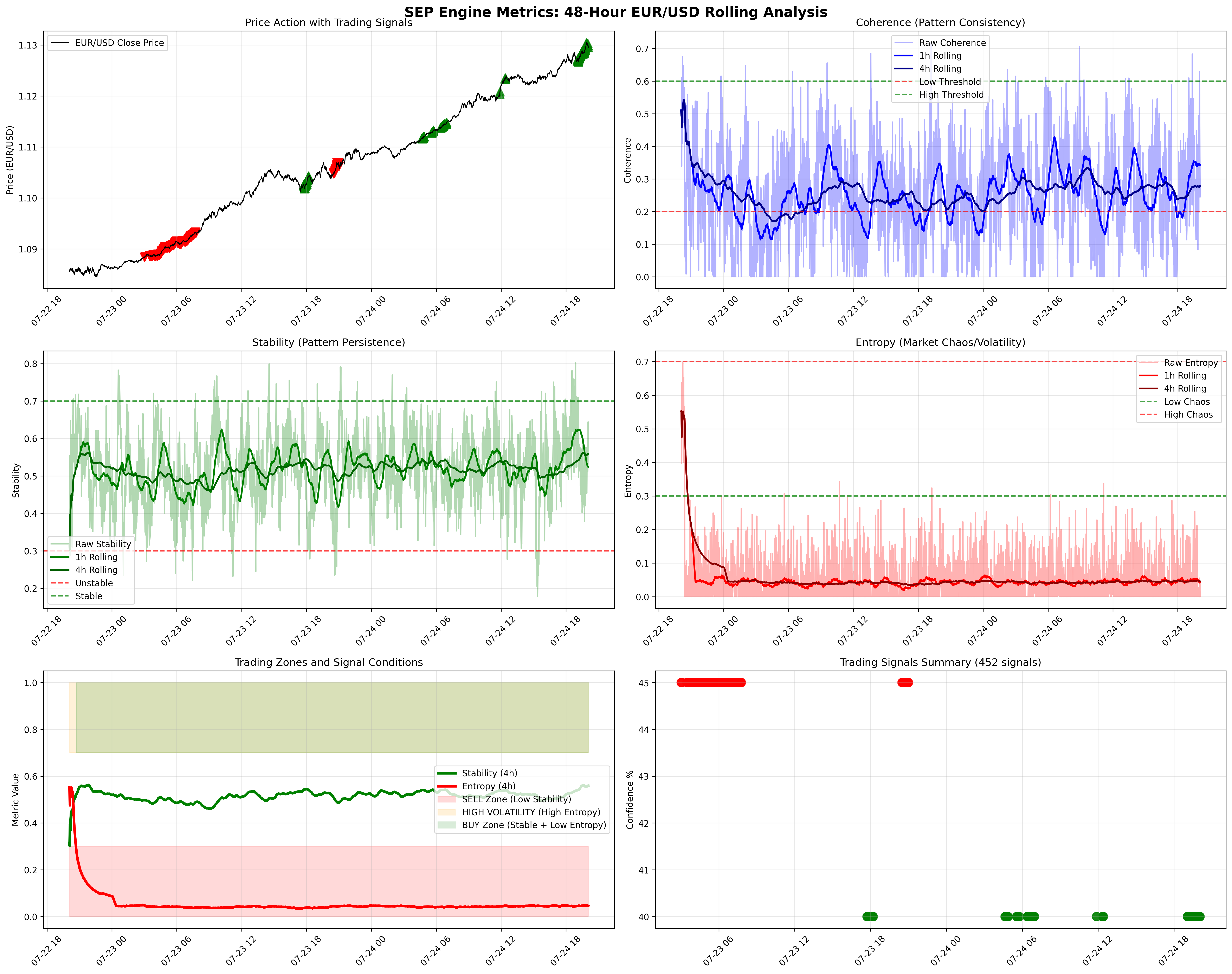

- Workbench Integration – display SEP metrics in a real-time dashboard and run 48‑hour historical analyses.

- Pattern Discovery – identify threshold combinations that predict market direction.

- Validation Framework – measure correlation between metric changes and price movements.

Verified Components

- Authentic market data via OANDA Connector.

- CUDA-accelerated Pattern Kernels.

- Metrics Monitor for coherence, stability, and entropy calculations.

- Live OHLC parser transforming candles to quantum patterns.

Comprehensive Analysis

The figure below illustrates a 48‑hour EUR/USD dataset with SEP metrics, rolling averages, and trading signals. Stable regions align with successful buy signals, while chaotic periods trigger sells.

Video Analysis: The Law of Large Numbers

We recently reviewed the educational video The Law of Large Numbers. It traces the history of probability theory from the law of large numbers to Markov chains and the Monte Carlo method.

These concepts are directly relevant to the SEP Engine. Markov chains align with our pattern evolution algorithms—each state transition depends only on the current pattern metrics, enabling coherent signal generation. LLN explains why metrics stabilize when analyzing long sequences of market data, while Monte Carlo simulations inspire our backtesting and risk management plans.

This connection reinforces our probabilistic foundation and guides upcoming improvements to the trading platform.